Payment Times Reporting Bill - does it go far enough?

It seems that the Federal Government has realised that as the ‘engine room’ of Australia’s economy, SMEs need more support to kick-start the nation out of slowdown and back into high gear. This is good news for the sector.

By Michael Mekhitarian

Getting to the crux of the issue

There is very welcome news for SMEs right now as Parliament gets set to pass the Payment Times Reporting Bill 2020.

The bill, which is a great step forward, currently proposes to make it mandatory for businesses with an annual income of over $100 million to provide biannual reports on their small business payment terms and practices.

The thinking behind the legislation is that it will enable greater transparency, and will allow small businesses to make more informed decisions about their potential customers.

The bill also puts some pressure on large businesses to improve their payment times, because compulsory reporting should in turn make it easy for the ‘slow payers’ to be identified.

If passed, the requirement will begin from 1 January 2021.

So, yes. The new laws (if passed) are a step in the right direction and will help small businesses to some degree. But the Federal Labor party hit the nail on the head when it said in its current form the bill won’t necessarily guarantee that small businesses GET PAID ON TIME.

And, as we all know, this can have a huge impact on cash flow.

Really, while it’s fantastic that under these proposed new laws the big companies would need to be open about their payment schedules, the real crux of the matter is actually making sure that the money is handed over in a more timely way.

To that end, the Labor Party will be pushing for amendments that will force any large businesses not paying small businesses on time to do so within 30 days, or face hefty fines.

Labor will seek to move the amendment when the bill is debated in the Senate later this week. This is something that SMEs have long been campaigning for, and it would signal impetus for real change if the amendment goes through.

However, the overriding good news, of course, is that the issues facing small business are firmly on the Federal Government’s agenda right now. As they should be. Because (pre-Covid) SMEs accounted for 35% of the nation’s GDP.

SMEs will lead Australia’s economic recovery

I’ve written recently about how SMEs will lead Australia out of recession, and I firmly believe this. With the support of sensible tax policy and other mandates to help SMEs improve cash flow, then SMEs will be unstoppable.

While all businesses have been severely tested by Covid-19, SMEs have superpowers: They are nimble, adaptable, and, I say this with the utmost pride – just able to get stuff done on the ‘smell of an oily rag’. It never ceases to amaze me how creative and innovative SMEs are, especially when cash is tight.

Planning your next steps

And those SMEs that play to these strengths over the coming months by knuckling down and getting their overheads and administration costs under control, and focusing on the most profitable ways to grow their business, embrace digital transformation, or seek partnerships and other forms of collaboration to meet new markets, as well as foster customer loyalty, will succeed. And along with that success, they will slowly build strength back into the economy.

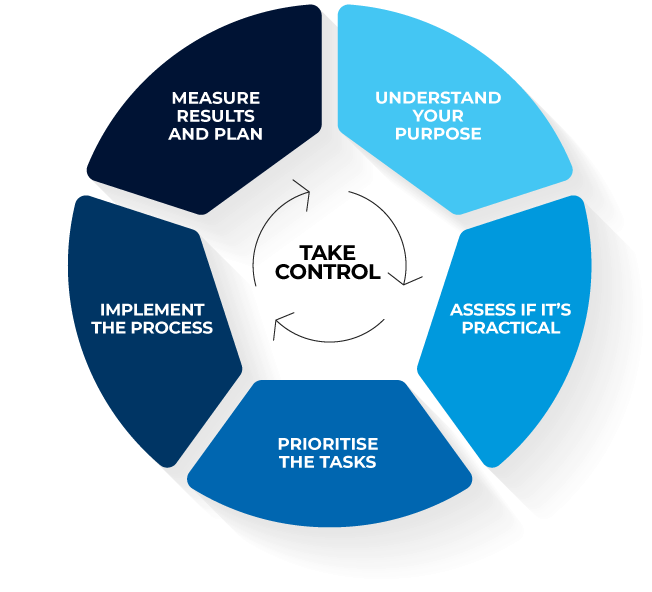

5-Step process for taking control of your business

So, if you’d like help planning the next steps for your business, then download our free e-book: the five-step formula for taking control of your business.

At ATB partners we offer taxation and accounting advice, along with virtual CFO services, as well as business planning and mentoring and financial planning advice. We have more than 60 years combined experience helping small business. We understand the unique issues you face, and the challenges that lie ahead. Feel free to contact us at any time.