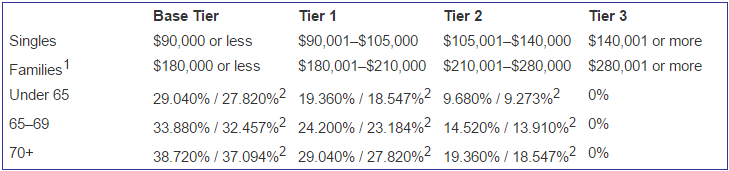

Private health insurance rebate percentages for 2014/15

The Private Health Insurance Rebate Percentages that apply from 1 April 2015 have been released.

The table below sets out the rebate percentages for the 2014/15 income year.

Notes:

1. Single parents and couples (including de facto couples) are subject to the family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first.

2. The first percentage specifies the rebate percentage that applied from 1 April 2014 to 31 March 2015. The second percentage specifies the rebate percentage that applies from 1 April 2015 to 30 June 2015.

The private health insurance rebate has been indexed from 1 April 2014. From that date, the rebate contribution from the government is annually adjusted by a universal Rebate Adjustment Factor (RAF).

The RAF represents the difference between the Consumer Price Index (CPI) and the industry weighted average increase in premiums. The RAF is enacted by the Private Health Insurance Legislation Amendment Act 2014 and is set out in the Private Health Insurance (Incentives) Rules.

A person’s rebate entitlement continues to be based on their age and income for Medicare levy surcharge purposes.

Source: ATO website, “PHI income threshold tables (Rebate entitlement by income threshold, 2014/15 (Table 10)”.

This article is provided as general information only and does not consider your specific situation, objectives or needs. It does not represent accounting advice upon which any person may act. Implementation and suitability requires a detailed analysis of your specific circumstances.