The ATO has your ‘side hustle’ in sight

The ATO recently sent out a warning that it is looking closely at ‘side hustles’ and first-time investors. If you have earned extra income, whether it is a a one-off lump sum, a regular pay check or money from a market stall, then you need to declare it to the tax department.

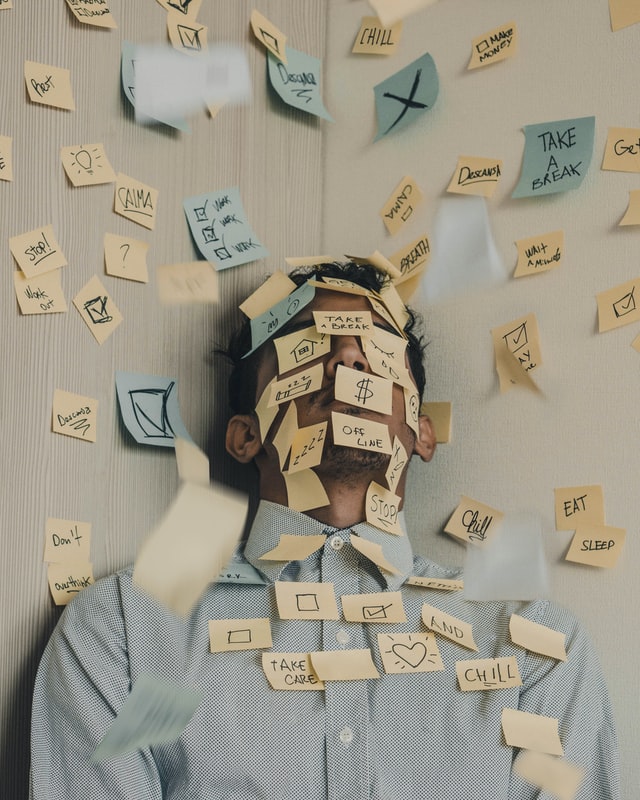

So, it’s important to take care with your paperwork and record keeping throughout the entire year.

By Jim Vass

Second incomes have become popular during the pandemic

Despite all the distraction of Covid, it is business-as-usual at the ATO and its focus this year is on second and third income streams. So, if you have a second job, or you’re driving Uber on the side, have an AirBnb, or make money from Etsy or Amazon, your tax return will be scrutinised.

Additional income needs to be included in your tax return and taxed at your marginal rates. It should be kept in mind that this income is generally not taxed upon receipt so you need to have set aside an amount to cover the tax for the current year.

It is also likely that this income may put you into the ‘pay as you go’ instalment cycle and you will need to pay quarterly instalments during the year based upon what the government perceives your business income to be.

The ATO will be watching what you declare as income, and also any expenses you declare as related to making that money. There will be legitimate deductions, but it’s wise to get professional advice. In fact, a tax agent’s fees are tax deductible in the following year, so there’s no reason not to seek help.

Are you serious about your 'side hustle'?

A lot of people have picked up ‘side hustles’ during the pandemic, for some it’s been a matter of making ends meet, but that money still needs to be declared to the tax department accordingly, and appropriately.

If your ‘side hustle’ has the potential to become a legitimate business, then you will also want to get professional advice about set up, tax obligations.

An accountant can help you the right systems in place to make tracking income and expenditure easier at tax time.

You would also be wise to get help, from a business mentor, for example, about how to set up a solid business foundation so you can eventually transition into it, and away from your current job, if that’s the ultimate goal.

First-time investors are also in the spotlight

A record number of people are using apps and other online platforms to invest in stocks, exchange-traded funds (ETFs), cryptocurrencies etc, and the capital gains from these investments must also be declared in your annual tax return.

While you should proceed with caution when it comes to go-it-alone investing. I recommend you read our article about the experience of some of those investors who got caught up in the GameStop rush earlier this year, and the article about the rise of Financial Influencers on Social Media…

But if you’re prepared to take the risks, then it can be an interesting pastime. One thing you need to be aware of is that you cannot claim ‘paper losses’ — falls in value if you continue to own the stock. If you sell at a loss, then you can, if they satisfy the ATO’s non-commercial losses rules.

Get the right advice -- for financial planning, business building and tax

Tax is complicated. Tax around second income streams, particularly investments, is even more so. It’s possible too, that when you’ve declared everything, you could find yourself with a bigger tax bill than usual, but a tax agent can help you set up a payment plan with the ATO.

At ATB we have financial planning expertise to help you build wealth, accounting and tax specialists and business mentors. If you find yourself in any of the situations mentioned here, then we’re here to help. Contact us.

This article is not intended to be taxation advice.

You should always seek advice from a professional about your own personal circumstances.