What the Federal Budget means for you

Last night Scott Morrison and the Liberal Party released their new budget for 2017, with a prediction that the budget will return to surplus by 2021 despite the fact that the government are around $600 million in debt; and there are some distinct winners and losers.

For first home buyers, the government are now allowing people to use their superannuation as a home deposit. From the first of July, these individuals will be able to sacrifice their gross income over the superannuation contribution for up to $30,000. This cash, along with any interest it earns can be withdrawn from July 1, 2018, with the earnings being taxed at 15%, and withdrawals taxed at 30% below the marginal tax rate. The Treasurer notes that this will accelerate savings by around 30% compared to a typical deposit savings account.

Baby boomers who’s children have moved out are being encouraged to downsize their homes from July 1, 2018, and sell them to younger, growing families. The government will encourage this through allowing people 65 years and older to make non-concessional superannuation contributions of up to $300,000 from the money earned from selling their home if they have lived there for a minimum of 10 years. This contribution works alongside existign contribution rules and caps in place, and is exempt from the age test, work test and the $1.6 million balance test for making non-concessional contributions.

The Medicare rebate freeze is set to be lifted, with added incentives for doctors to bulk bill patients from July 2018.The index freeze on consultations is set to be lifted next year, and specialist procedures being lifted in 2020 for advanced procedures including radiation. An estimated $1.8 billion is said to be saved through encouraging medical professionals to prescribe generic medicines, and a $510 million Pharmaceutical Benefits Scheme is being introduced to develop a new drug for patients with chronic heart failure.

Pension concession cards are being restored to those individuals who lost it after the changes made to the pension assets tests earlier in the year, allowing seniors to access state and territory concessions. One-off cash payments will be provided to 3.5 million individuals on age and disability pensions, to cover winter electricity bills. The amounts will be $75 for singles, and $125 for couples. Home support services will receive $5.5 billion in government funding for elderly Australians.

University students will face a 7.5% increase in tuition fees starting in 2018, which will be phased in over a four year period. HELP (previously HECS) loans will need to be repaid once an annual income of $42,000 is being earned, instead of the previous $54,869. High income earners (over $119,882) will have to repay 10% of their income instead of 8%. As well as this, the repayments will now be indexed at the consumer price index instead of weekly wages, meaning that individuals will be making higher repayments in the long term. Despite this increase in fees, the government are still looking to cut a further $2.8 billion from university funding over four years, which is dependent on their performance.

For school children, the Gonski Scheme will inject $19 billion over the next decade, however it will no longer discriminate between public, private and catholic schools. This means that 24 of the wealthiest schools in Australia will experience ‘negative growth’ in their funding, however, 9,400 schools will see an increase in funding. Funding within the school system will increase from $17.5 billion this year to $22.1 billion by 2021, and $30.6 billion by 2027.

For small business owners, the $20,000 instant asset tax write-off which was introduced in the previous year’s budget is being extended until June 30, 2018. It will be open to businesses with a turnover of up to $10 million instead of $2 million. Payments of up to $300 million over two years have been promised to cut red tape for small businesses, with the burden already being reduced by around $5.8 billion.

Property investors will see that negative gearing rules are being tightened, with individuals no longer being able to claim tax deductions on travel expenses relating to investment properties. This change comes due to widespread rorting, with people claiming deductions for private travel. Depreciation deductions for plant and equipment items are also being tightened. The only deductions that are now able to be claimed, are those individuals have purchased themselves.

Foreign investors in the Australian property market can no longer claim the primary residence exemption for CGT purposes, which is expected to earn $581 million in revenue over the next four years. On top of this, if foreign investors fail to rent out a property for six months of the year, a ghost tax will need to be paid, for an amount equal to the foreign investment application (at least $5,000). Australian property buyers will be given higher opportunities to make purchases, with a 50% limit being imposed on new developments which are able to be sold to foreign investors.

The government have imposed the banks with a levy of $6.2 billion over four years as a budget repair measure, applying to Westpac, ANZ, the Commonwealth Bank, NAB and Macquarie Bank. With this levy, banks with $100 billion or more in liabilities will be taxed 0.06% on those liabilities each year. Scott Morrison claims this to be a fair tax given that banks earn around $30 billion in profits annually, and so doesn’t think they will pass this on to consumers.

Despite the impacts this budget will have on Australians, the government appears to be doing less and less to support those living in developing countries. Even though the Australian foreign aid contribution has been shrinking in recent years, it will again be frozen for the next two years, with developing nations losing out on $303 million in this time period. The foreign aid budget reached its peak in 2012-13 at $5.6 billion, and has now fallen at its lowest proportion of gross national income in the history of Australia.

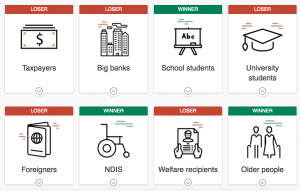

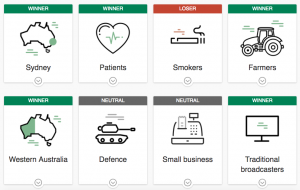

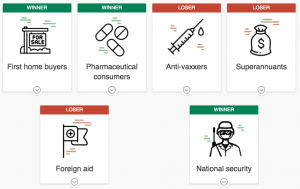

The ABC have made a cheat sheet which indicating the winners and losers from the Liberal Party budget.