Invoice payment terms: Top seven tips

Small business cashflow depends on prompt payment. We analysed over 12 million invoices to discover some revelations about getting paid on time. We also asked the small business community for their tips and tricks.

You’re not alone: Invoicing insights from small businesses

Over 1,500 members of an online business community shared their experiences about invoicing and payments with us. We’ve taken the best of their helpful advice and feedback, and summarised it here. We start with some of their challenges, suggestions and advice, then we list the top seven tips for getting paid faster.

The most challenging aspects of invoicing

Invoicing isn’t always straightforward. The basics are simple enough once you have an invoicing system in place, but other commitments and interruptions can sometimes get in the way. Our online business community members came up with the following invoicing challenges:

• Getting invoices out on time when you’re busy.This is a common problem. When your business is thriving and you’re busy working to make money, taking the time out to send invoices can be difficult. Consider using cloud accounting software to quickly prepare and send invoices.

• Following up on overdue invoices. This is related to the previous point – time is always at a premium in a busy small business. Again, cloud accounting software can help by automating reminders based on your settings.

• Splitting payments across multiple invoices. Account reconciliation can be tricky at times. Make sure your clients include your invoice numbers as references for every payment they make, to help you work out which invoices have been paid.

• Invoicing quickly and accurately. It’s important that your team communicates effectively with your finance manager or accountant, to ensure that work carried out is invoiced properly every time.

• Ensuring that all completed work is invoiced. Time-tracking software can be useful here, especially when there are several people working on each client account. Be sure to get this right, otherwise your business will be throwing away money by working for nothing.

• Creating an invoice that doesn’t go to the bottom of the pile. You can design your invoices so that they stand out, but what’s more helpful is to build up a good working relationship with your client’s accounts department. Don’t rely on a pretty invoice to get you paid.

SUGGESTIONS FOR GETTING AN INVOICE PAID

Sending an invoice is only part of the process of getting paid. Some of your customers will pay on time and without reminders, but others may need to be prompted. Here’s a selection of ideas the online community had:

- Add ‘overdue’ fees

If you’ve set your payment terms out clearly on your invoice and the client has ignored them, in most countries you are entitled to charge interest in the form of overdue fees. Be prepared for robust feedback from your clients if you go down this route, and consider reversing the charge once the lesson has been learned.

- Communicate with your clients

Sending out reminder emails can help, but if your client’s accounts department doesn’t really know who you are, they might ignore your reminders. A better option is to pick up the phone and talk to someone. Reminders from a real person are much more persuasive than automated emails.

- Keep your payment terms short

Why wait 30 days for payment when you could be paid in a week? If you’re serious about the work you do, and if you try your best to supply your products and services to your clients’ deadlines, there’s no reason why they shouldn’t try their best to pay you just as quickly.

- Call early and call often

Let the client know immediately if their account is overdue. Send a statement or reminder after a few days, and pick up the phone if the payment is overdue by a week or more. Don’t let it drift.

THINGS YOU SHOULD KNOW ABOUT INVOICING WHEN STARTING YOUR BUSINESS

Hindsight is a wonderful thing. Most people don’t know a great deal about invoicing when they start their first business, so it’s good to learn from people who have already been through the learning process. Here are some tips:

- Track time accurately

It’s not enough to do the work and then try to recall how much time you’ve spent on it. Set your timer going when you begin and switch it off when you finish. Include all the hours you work on each client’s projects. That way your invoices will be accurate. - Follow up invoices

Don’t just ‘fire and forget’ – follow up invoices politely but firmly. Invoices might be ignored, lost in the mail or left unopened in the recipient’s spam email folder. So follow up and make sure your invoice has been not only received, but actually opened and read. - Account for administration time

For some business owners, they said that invoicing can take up to 10 percent of work time in terms of creating, sending and chasing invoices. That can cause a drag on your other administration work, so be sure to factor this into your planning and accounting strategies. - Invoice the right person

That’s not always the same as the person you’re actually doing the work for. Make sure you get the correct billing details for all your clients, otherwise your invoice could end up on the wrong desk… and stay there. - Invoice on the go

Why wait until you get back to the office to send an invoice? Some of our online community members have sent invoices while on the train, from airport lounges and even while volunteering at summer camp. Cloud accounting software makes that easy. The smaller the time gap between providing the service and issuing the invoice, the more likely it is that you’ll get paid quickly.

TOP SEVEN TIPS TO GET PAID FASTER

Getting paid and having a healthy cashflow is the lifeblood of every small business, but it’s not always as easy as sending an invoice at the end of the month. You’ll be laughing straight to the bank with these top invoicing tips.

- Discuss payment terms before you get started

Getting this sorted upfront means that there is no confusion down the track. It also sets the clients expectations around payment before you start the work. - Keep detailed records of inventory and time

This saves time when it comes to creating the invoice and makes sure you don’t miss anything. It also means if things are going over budget you can let your client know, instead of sending them an expensive surprise at the end of the month. - Make the invoice clear and easy to understand

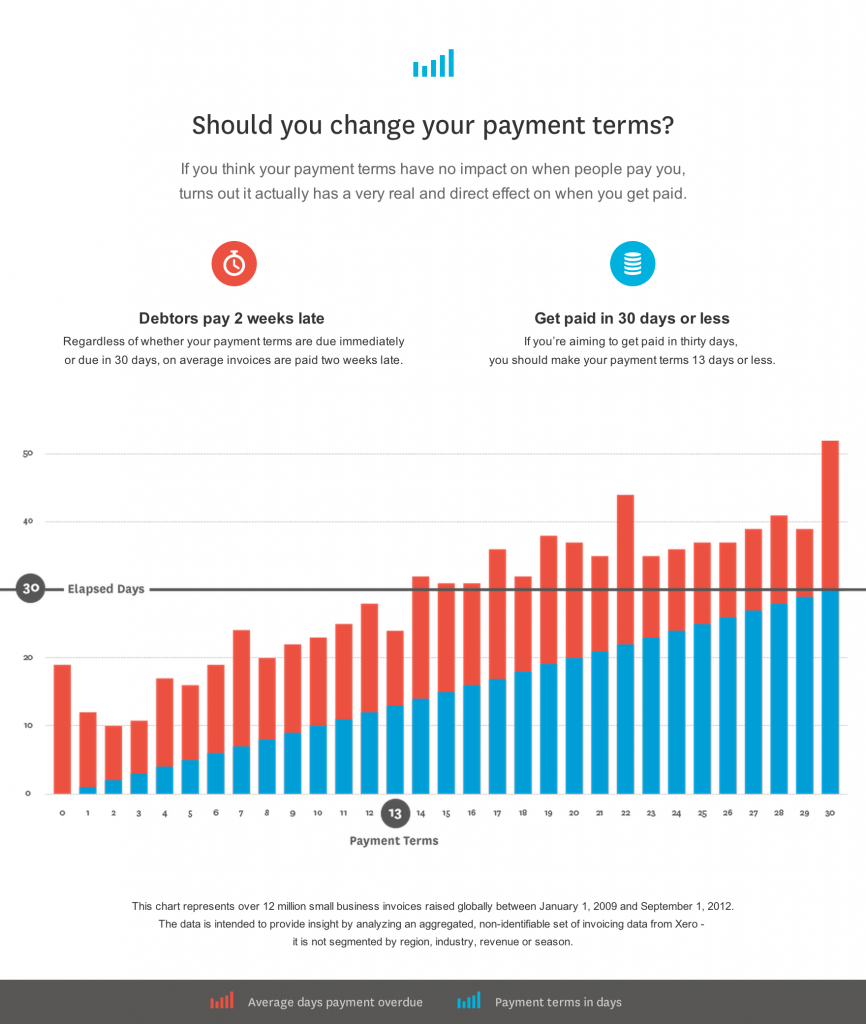

List the details of the job in a way that makes sense to the client, any confusion could create a payment lag. It’s also good to personalize your invoice with your business logo – it helps carry on the professionalism of your work. - Set appropriate payment terms

If you need to receive payment within 30 days, our data reveals that you will need to set your payment term 13 days or less. Keep in mind that on average, debtors pay invoices two weeks after the due date. - Address the invoice to the person paying

Make sure your invoice goes straight to the person who makes payment to avoid getting lost in someone else’s inbox. If you’re unsure exactly who that is, give them a call – it pays to know the person paying the bills. - Invoice as soon as possible

Send your invoice as soon as possible, the sooner a client receives an invoice the sooner they will make payment. It also means they will receive it when the value of your work is still fresh in their mind. Accounting software that lets you create professional recurring invoices will streamline the invoicing process. - Keep on track with debtors

The squeaky wheel gets the oil. When things become overdue send reminders, monthly statements or make a phone call. It will help remind your client that you are serious about getting the invoice paid. Some accounting software sends you an update when the invoice has been opened.

ADJUST INVOICE PAYMENT TERMS TO SUIT YOU

Being a small business owner often means you’re short on time, but it’s worth making the effort to get your invoicing set up properly. Having a process that helps streamline invoicing can drastically reduce the amount of time you spend collecting your hard-earned money. And that’s got to be great for your business.

This article was originally posted on the Xero website.

This article is provided as general information only and does not consider your specific situation, objectives or needs. It does not represent accounting advice upon which any person may act. Implementation and suitability requires a detailed analysis of your specific circumstances.