The Reality of Foreign Investment into Australia

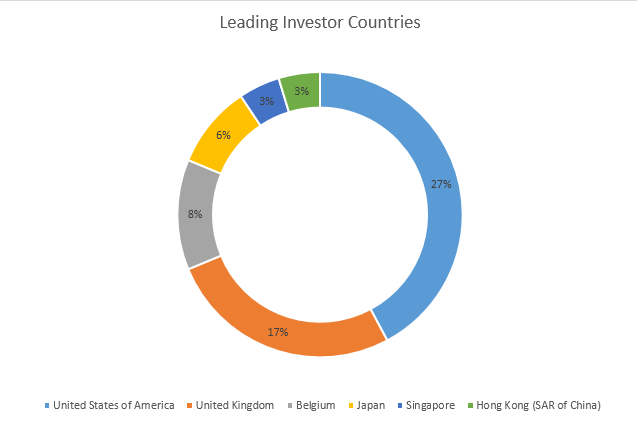

Recent headlines have been painting China as the primary investor into the country, however, this is not the reality of foreign investment into Australia. While there has been a substantial increase in the level of property investment from Chinese investors in recent years, the property market cannot be the only sector the Australian public considers when making these claims. According to the Australian Bureau of Statistics (ABS) report on December 31, 2014, the leading investor countries were as follows:

- United States of America $758.2b (27%)

- United Kingdom $484.2b (17%)

- Belgium $226.1b (8%)

- Japan 174.7b (6%)

- Singapore $80.2b (3%)

- Hong Kong (SAR of China) $77.3b (3%)

While the Chinese foreign investment into Australia is expanding, it is only a small part of the picture. In the 2013-14 financial year, 40% of foreign investment from China ($12.4b) was directed towards Australian real estate whereas countries such as the USA and Japan was focused on business and commercial properties.

It is expected that in the coming years, there will be a further expansion in the foreign investment of both America and China, and this is already underway. In May this year the California Public Employees’ Retirement System, which currently holds approximately US$300b worth of assets, made a deal with an investment group in Brisbane to find and manage $1b in infrastructure assets in the Asia-Pacific region.

More deals such as this are expected to arise, and this will further change the face of foreign investment in Australia. Adding to this, the free trade agreement with China (ChAFTA) which was signed in June this year will allow Chinese investors to make a single investment of up to $1.08b without a review by Australian regulator officials. This does also mean that Australian investors are now opened up to one of the largest economies in the world, which is both beneficial to individuals and businesses.